From small mom-and-pop shops to multi-million dollar corporations, knowing who you’ve paid or who owes you is vital for a successful operation.

Here is an overview of how companies use accounting to keep track of their money.

Journal Entry

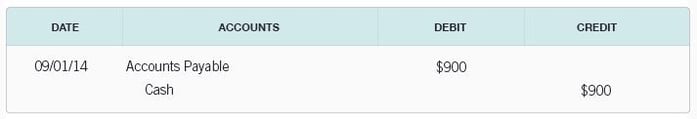

When a company has a transaction (i.e. buys a piece of equipment, sells inventory to a customer, etc.), they will record this transaction by creating a journal entry. The journal entry shows the date, the accounts that are involved with the transaction, as well as the amounts of money.

Below is an example of a journal entry. There are two accounts involved in this journal entry, Accounts Payable and Cash, and there are two amounts, $900 and $900. Notice that those amounts are the same—this should always be the case! Depending on the size of the company, there can be hundreds, thousands, and even millions of journal entries made each year!

General Ledger

Have you ever heard the phrase ‘on the books’? This is referring to a company’s general ledger, which used to be a large, hand-written book containing all of the financial accounts of an organization. The general ledger is basically like the diary of a company, showing a chronological listing of transactions.

Below is an example of what a general ledger used to look like. Thankfully, most of this is done on computers now!

Trial Balance

The trial balance contains a listing of a company’s financial accounts along with their balances. It’s a tool that helps check the clerical accuracy of transactions that have been recorded to date. As its name suggests, it’s a trial or a test to see if all of the entries add up, or balance, properly before creating the financial statements.

Financial Statements

Financial statements are prepared reports that represent the financial operations of a company. They can be used internally by managers to make strategic decisions; they can be used externally by stakeholders to make investment decisions. The most commonly known financial statements are the Balance Sheet, The Income Statement, and The Statement of Cash Flows.

The Balance Sheet shows a company’s assets, liabilities, and shareholders’ equity for a given point in time (usually year-end).

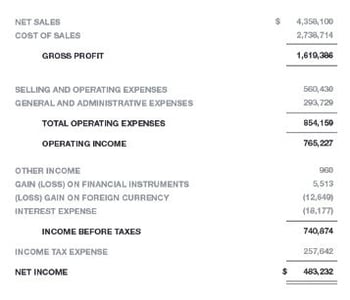

The Income Statement summarizes the revenues and expenses over a given period of time (usually one year).

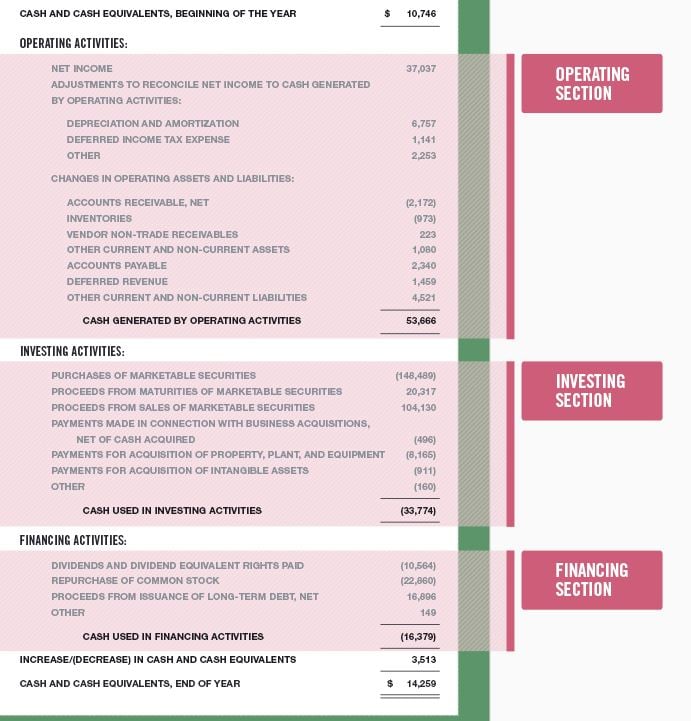

And, The Statement of Cash Flows summarizes a company’s cash flows related to operating, financing, and investing activities.

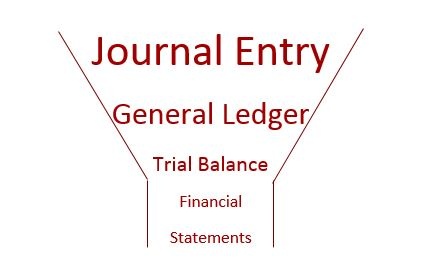

It can be helpful to think about this accounting process like a funnel. As we move down, the information gets less detailed and more concentrated.

Each of these processes play an important part in accounting and help businesses to understand, track, and improve how they earn and spend money.

Interested in learning the language of business? Take HBX CORe and discover the basics of Economics for Managers, Financial Accounting, and Business Analytics.

About the Author

Christine is a member of the HBX Course Delivery Team, focusing on Financial Accounting and Disruptive Strategy. She holds a B.S. in Management from UNC Asheville, an M.S. in Accounting from Northeastern University, and an MBA from Northeastern University. In her spare time, she enjoys reading business journals and watching NFL games.