How does insurance work and why is it so complicated? We will begin to answer these questions and more in a three part series on insurance markets.

Simply put, insurance is the business of buying and selling risk. In many situations, businesses and individuals are risk-averse. This means that they would prefer to pay some amount of money to reduce the amount of uncertainty in a situation.

For example, consider a simple coin flip game. If the coin lands on heads, you receive $100,000. If it lands on tails, you receive nothing. The expected value of your winnings is 50% * $100,000 + 50% * $0 = $50,000

Would you prefer to play that game, or just get a guaranteed $50,000?

Most people would prefer the guaranteed $50,000. What about $49,000?

If you would prefer $49,000 we consider you to be risk averse. You are willing to pay a premium of $1,000 to eliminate the uncertainty in this situation.

Of course, this is a somewhat frivolous example. Instead, let’s consider one of the oldest examples of insurance in the real world: property/home insurance. Modern property insurance goes back to shortly after the Great Fire of London. There was a desire among individuals to reduce the financial risk of losing their homes to fire. And companies (i.e. insurers) were founded to meet this need.

Let’s look at the economics behind this:

Let’s assume someone owns an apartment valued at $500,000 and that the insurer only offers one type of insurance, total insurance. Essentially this insurance will pay for any damage done by fire over the next 5 years.

The probability of loss over that time period is as follows:

- 1% chance of total loss ($500,000 cost)

- 2% chance of minor loss ($100,000 cost)

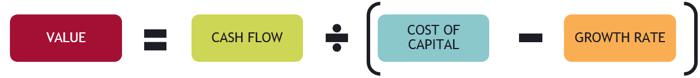

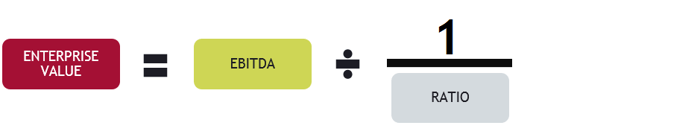

From the individual’s point of view, their expected loss is 1% * $500,000 + 2% * $100,000 = $7,000. Since the individual is risk-averse they are willing to pay at least $7,000 for the insurance policy, but let’s say the insurer charges around $10,000. This cost can be thought of as three parts:

- The actual expected payout to the individual = $7,000

- The risk premium (the cost to the insurer for having additional risk) = $500

- Overhead and administrative costs of providing insurance = $2,500

In this case, if the individual opts for the insurance coverage, they are willing to pay a $3,000 risk premium over the anticipated $7,000 in damages to insure against the risk of a greater loss. There is an important insight here: Insurers are better equipped to handle risk than individuals. As a result, that $500 risk premium the insurer faces is a lot lower than the $3,000 risk premium the individual is willing to pay. Why is this?

In fact, there are a number of reasons insurance companies can better handle risk (e.g. “floating” premiums until claims need to be paid), but the biggest reason comes down to simple probability.

Think back to the coin flip game from earlier. Imagine that the game is now a 50/50 chance at $10,000 and you get to play 10 times. The expected value is still $50,000. But now would you accept a guaranteed $49,000 over the game? Maybe not. That’s because by playing the game many times, you reduce the uncertainty. Since an insurance company can take on many customers, it can effectively reduce the amount of uncertainty it faces.

Below is a diagram showing the probability distribution of winnings in the coin flip game based on if you play once (individual) or if you play 10 times (insurance company).

.png?width=841&name=Ben%20Graph%20(10).png)

And now we can see what the graph looks like if the game is played 100 times. Here the insurance company would always get between $40,000 and $60,000. So that is very little risk compared to the 50/50 gamble the individual faces.

.png?width=841&name=Ben%20Graph%20(100).png)

This very simple result shows how insurance companies are able to manage risk, allowing them to create value which is passed on to consumers. Of course in practice, some (or all) of that value is lost due the overhead costs associated with insurance companies (but that is a much more complicated topic).

One key assumption we are making throughout this post is that insurance companies and individuals have the same information and are aware of how likely a “loss” is to happen. What happens when individuals know more about their potential for loss than the insurer does?

The next post in this insurance series will look at exactly that, and more generally the topic of adverse selection.

Interested in expanding your business vocabulary and learning the skills Harvard Business School's top faculty deemed most important for any professional, regardless of industry or job title?

About the Author

Ben is a member of the HBX Course Development Team and works on the Negotiation Mastery and Economics for Managers courses. He has a background in economics and physics and enjoys card games, cooking, and discussing philosophy.

Ben is a member of the HBX Course Development Team and works on the Negotiation Mastery and Economics for Managers courses. He has a background in economics and physics and enjoys card games, cooking, and discussing philosophy.

.png?width=797&name=Office%20(FAE%20Blog%20Post).png)