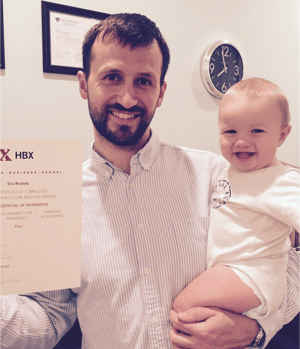

We sat down with Cody Signore, one of our Senior Multimedia Producers, to talk about his experience filming and producing our newest HBX course, Negotiation Mastery: Unlocking Value in the Real World.

Who were the most interesting people you met while filming Negotiation Mastery?

All of them were fantastic. Betsy Broun, the Director of the Smithsonian American Art Museum, was great to talk to and her perspective on dealing with business and art was really interesting – how do you put a price on someone’s creativity? Chris Voss, a former FBI hostage negotiator and CEO of The Black Swan Group Ltd., told some fantastic stories. Many people we filmed talked about the importance of compromises, and then you have Chris who says that you can’t compromise. After all, you can’t say, "give me two hostages, and you keep the rest." Everyone we spoke to had interesting perspectives and we really experienced the differences in cultures and opinions from around the world.

How is it trying to negotiate with Professor Wheeler?

Ha, it was good! You know you're going to lose any negotiation with him, but he's a fantastic person, so I didn't have to worry. We learned a lot from him and those lessons informed how we presented information. He teaches the importance of empathy and knowing what the other side wants. We learned from that, anticipated what questions he would ask, and prepared answers to them ahead of time. It really raised the bar for us in terms of both production and creativity.

What was your favorite location you traveled to for Negotiation Mastery?

London and Dorset in the United Kingdom. Dorset is a small town with incredibly friendly people, and it's so peaceful. After the first three days we were there, we realized we hadn’t even seen a police officer! We did see a lot of sheep though.

Tell us about what it's like filming course content.

We try to get symbolic city shots from everywhere we go in order to give students the feeling that they are traveling the world with us. When we went to DC, we only had one day, so everything was really compressed. In a four-hour span we saw everything on the National Mall, circled the White House, and then went back to the airport. That’s pretty much how it went in every city we were in! There is so much that goes in to planning for these trips, as well as carrying and keeping track of seven bags of gear as you're moving around different cities.

How long it takes to edit a 30 second clip of content?

About an hour, give or take.

What do you like most about seeing these courses come together?

From the multimedia perspective, it’s an interesting task and difficult in some ways. Our videos are like a five hour documentary - one that you’re trying to launch, monitor, and plan for in a quick amount of time. It’s only been nine months since I was brought onto this project as a producer, and the course is launching next month! It has been satisfying to see all the pieces come together, from planning with different teams, to seeing concepts come together in animations, to seeing the videos, music, and all other aspects of the course work together to give the student an incredible learning experience.

What's the best advice someone has ever given you?

A teacher of mine when we were in film school told us, “The only reality is through the view finder.” No one else sees everything that is outside of the frame of your shot. They only see what you’re showing them. I thought this was fantastic because a single frame can say so much, and I think about that a lot as we pursue creative things here.

The other one is to always carry a Sharpie and a pen!

What’s your favorite part of your job?

Collaborating with everybody and trying to take that small idea and make it into something big, interesting, and accessible.

Finish this sentence: When I’m not at work, you can find me...

With my family and/or doing something creative.

What was your first job?

I worked at Party City as a seasonal employee for Halloween. I was there with some of my friends from high school, so it was quite an experience!

If you could travel anywhere in the world (that you haven’t yet been) where would you go?

I would love to go to Iceland.

Best book you’ve ever read?

Blood Meridian by Cormac McCarthy.

Favorite subject in school?

History!