Since earlier this month, when Tesla's market capitalization passed both Ford Motor Company and General Motors, news organizations have been trying to figure out what to make of the market's consensus. Is Tesla, a young, electric-car manufacturer, really worth more than these behemoth, hundred-year-old automotive powerhouses? How can a company like Tesla with a reported $7 billion in revenue for 2016 possibly be worth more than GM, with $166 billion in revenue?

There are a few things to unpack here, from what market capitalization actually means, to differing capital structures, and reliance on equity.

Market Capitalization

Market capitalization is one of the simplest measures of a publicly traded company's value, calculated by multiplying the total number of shares by the present share price.

One of the shortcomings of market capitalization is that it only accounts for the value of the equity of the company, while most companies are actually financed by a combination of debt and equity.

In this case, debt represents investments by banks or bond investors in the future of the company; these liabilities are paid back with interest over time. Equity represents shareholders who own stock in the company, and hold a claim to the future profits of the company.

So instead of analyzing the companies' market capitalization, let's a look at their enterprise values, a more accurate measure of company value which takes into account these differing capital structures.

Enterprise Values

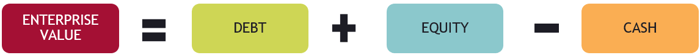

To find the enterprise value, we’ll combine each company's debt and equity, and remove the amount of cash the company is currently holding in their bank accounts, since that’s not part of their actual operations.

Tesla currently has a market capitalization of $50.5 billion. On top of that, their balance sheet showed liabilities of $17.5 billion (this isn't the market value of their debt, which would be ideal, but it's close enough for this comparison). The company also has around $3.5 billion in cash in their accounts, giving Tesla an enterprise value of approximately $64.5 billion.

We can repeat this exercise for Ford and GM. Ford has a market capitalization of $44.8 billion, outstanding liabilities (again, from their accounting balance sheet) of $208.7 billion, and a cash balance of $15.9 billion, leaving an enterprise value of approximately $237.6 billion. GM has a market capitalization of $51 billion, balance sheet liabilities of $177.8 billion, and a cash balance of $13 billion, leaving an enterprise value of approximately $215.8 billion.

Hopefully this understanding of enterprise value will provide some context to better understand the sensational headlines you’ve seen in recent weeks. In short, while Tesla's market capitalization is higher than both Ford and GM, Tesla is also financed more from equity. In fact, 74% of their assets have been financed with equity while Ford and GM have capital structures that rely much more on debt (17.6% of Ford's assets are financed with equity, and 22.3% of GM's).

When looking at the enterprise value of each company, it's clear that Ford and GM are still far larger companies than Tesla.

Why stop here? In our next post, we'll look at a key valuation ratio for the three companies to better explain why Tesla's market capitalization might be so high, even though the company is so much smaller than its rivals.

About the Author

Brian is a member of the HBX Course Delivery Team and is currently working on the new Leading with Finance course for the HBX platform. He is a veteran of the United States submarine force and has a background in the insurance industry. He holds an MBA from McGill University in Montreal.