Earlier this week, we analyzed reports of Tesla's market capitalization passing both Ford Motor Company and General Motors, and found that these eye-catching headlines can mostly be explained by the different capital structure of Tesla compared to its older rivals.

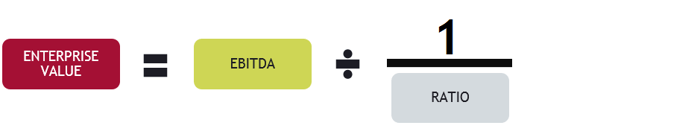

Today, we’re taking things a step further and discussing why Tesla might be valued so highly, despite being a very small company. To do this, we’ll need to look at the ratio of Enterprise Value (a finance term meaning the total operational value of the company) to EBITDA, an acronym for Earnings Before Interest, Taxes, Depreciation and Amortization.EBITDA

When examining earnings, financial analysts generally don't like to look at the raw net income profitability of a company because it's manipulated in a lot of ways by the conventions of accounting, and some of them can really distort the true picture.

To start with, the tax policies of a country seem like a distraction from the actual success of a company - they can vary across countries or across time, even if nothing actually changes in the operational capabilities of the company. Second, Net Income subtracts interest payments to debt holders, which can make companies look more or less successful based solely on their capital structures. That doesn't seem to make sense - so we add both of those back to arrive at EBIT (Earnings Before Interest and Taxes), which we call operating earnings.

Next, we look at depreciation and amortization. In normal accounting, if a company purchases equipment or a building, it doesn't record that transaction all at once - it charges itself an expense called depreciation over time. But the company isn't really spending any money on that depreciation; it isn't real. Amortization is the same thing as depreciation, but for things like patents and intellectual property; once again, no actual money is being spent on this expense.

In some ways, then, depreciation and amortization can take the earnings of a rapidly growing company look worse than a declining company, and that's definitely not right. This sort of distorted picture especially happens to companies like Amazon and Tesla.

Now that we understand how we arrive at EBITDA for each company, we can look at these ratios.

According to the Capital IQ database, Tesla has an Enterprise Value to EBITDA ratio of 36x. Ford's is 15x, and GM's is 6x. So what do these ratios mean?

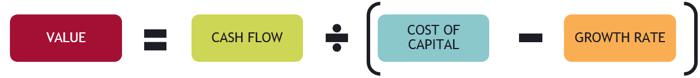

Present Value of a Growing Perpetuity Formula

One way to think about these ratios is as a part of the growing perpetuity equation. A growing perpetuity is a kind of financial instrument that pays out a certain amount of money every year, and that amount of money grows each year as well. Imagine an annual stipend for retirement that needs to grow every year to match inflation. The growing perpetuity equation allows us to find out today’s value for that sort of financial instrument. Here’s the equation:

So, in our retirement example, someone who wanted to receive $30,000 every year, forever, with a discount rate of 10% and an annual growth rate of 2% (to cover expected inflation) would need $375,000 [30,000/(10%-2%)]. That’s the present value of that arrangement.

What does this have to do with companies? Well, we can imagine the EBITDA of a company as a growing perpetuity paid out every year to the capital holders (both debt and equity) of the company. If a company can be thought of as a stream of cash flows that grow each year, and we know the discount rate (which is that company’s cost of capital), we can use this equation to quickly value the enterprise value of a company.

To do this, we’re going to need some algebra to convert our ratios to this formula. Let’s take Tesla, with an Enterprise to EBITDA ratio of 36x. That means the Enterprise Value of Tesla is 36 times higher than its EBITDA.

If we look at the growing perpetuity formula and use EBITDA as the Cash Flow and Enterprise Value as the value we’re trying to solve for in this equation, then we know that whatever we’re dividing EBITDA by (the Discount Rate – Growth Rate) is going to have to give us an answer that is 36 times what we have in the numerator.

In other words, the denominator needs to be 1/36, or 2.8%. If we repeat this example with Ford, we would find a denominator of 1/15, or 6.7%. For GM, it would be 1/6, or 16.7%.

The Power of Growth

Plugging it back into the original equation, we know that the percentage is equal to the Cost of Capital - Growth Rate, so we could imagine that Tesla might have a cost of capital of 20% and a growth rate of 17.2%. Or it might have a cost of capital of 13% and a growth rate of 10.2%.

The ratio doesn't tell us exactly, but one thing it does tell us is that the market believes that Tesla's future growth rate will be very close to its cost of capital (unsurprisingly, Tesla's first quarter sales were 69% higher than this time last year).

If we repeat this with GM, we might imagine a cost of capital of 20% and a growth rate of only 3.3% - much less optimistic than Tesla.

In finance, growth is powerful. It explains why, despite being a much, much smaller company, Tesla carries a very high enterprise value. The market has taken notice that, though Tesla is much smaller than Ford or GM in total enterprise value and revenues today, that may not always be the case.

About the Author

Brian is a member of the HBX Course Delivery Team and is currently working on the new Leading with Finance course for the HBX platform. He is a veteran of the United States submarine force and has a background in the insurance industry. He holds an MBA from McGill University in Montreal.