This post is from The Bitter Student, an online multimedia forum started by past HBX CORe participant Sam Campbell. Click here to see the original article.

In early May, I traveled to Boston, MA to attend the HBX ConneXt conference at Harvard Business School. The institution invited students who completed the online educational platform, HBX. I was a participant in HBX CORe and was part of the June 2015 cohort (shout out to my fellow classmates!).

CORe provides the fundamentals -- the ‘core’ concepts -- of business (accounting, analytics, and economics) from leading Harvard Business School faculty, who use the renowned case-study method.

In this post, I hope I can not only discuss my experience and journey with HBX CORe last summer and my trip to HBS, but hopefully, I can also provide some valuable insight and also inspire others to take these or similar courses.

As with any story, there was a beginning. That beginning was in June of 2015. At that time, I thought there would be no end. I could not see the light at the end of the tunnel, as you might say. Note: this is not where my inspiration or jollification starts.

I was still an underclassman in college, and had just concluded my first year. I was completing a full-time internship on top of the twelve hours of course work a week. The courses started right when school ended, and the program spilled over into the start of my sophomore year.

I remember groggily working on these courses after being brain dead from work or while at the beach with friends. The silver lining in all of this though was that I was not alone. There were multiple students who were completing this program during an internship, a 40+ hour work week, or other time-consuming commitments.

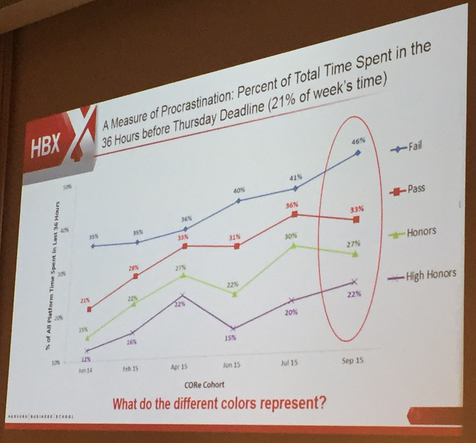

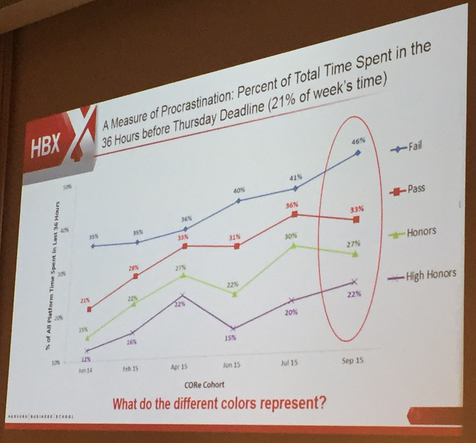

A takeaway here is: do not go into these courses thinking you can wing anything, or that the time commitment will be easy to juggle with other responsibilities. It’s possible to pass, but nearly impossible. We learned at the HBXConneXt conference that procrastinators were more likely to fail CORe, while those who focused their efforts more efficiently were more likely to reach high honors. Those who do not put work off and get ahead of their tasks are more likely to be successful in the long run (see chart below).

During the conference in May, there was a session titled: “What’s Next for Online Learning: A Conversation” featuring Anne Dwane (Partner & Co-Founder, GSV Acceleration), Larry Culp (former CEO of Danaher Corp. and senior lecturer at HBS), and Chip Paucek (CEO & Co-Founder at 2U, Inc.). The guest speakers mentioned a couple of thoughts (of which I, of course, took note) about what they think when they see HBX CORe on someone’s resume. I am paraphrasing here; nonetheless, the speakers noted:

- Desire. Hunger. Self-motivation. Bias to invest in oneself.

- Lead & win potential.

- Talent in plain sight.

- Risk takers because they had confidence in an organization's newly founded program and confidence in themselves to complete the program.

- Real results. Hard work. Not superficial.

- Aspiration.

Why persist, you might ask?

I can’t speak on behalf of my cohort, but I persisted for three reasons:

- I believe knowledge is more than the timeless idiom, “knowledge is power.” Knowledge isn’t just power. Knowledge can be used to empower. It equips us with the tools to help us make a difference in the world.

- As Michael Priest tells us this in his book 101 Things I Learned in Business School, "Those most likely to be successful in business in the long run have the broadest and most open understanding of it.”

- We are at a time in history and live in a world where we need leaders now more than ever.

Community and connection

The platform also requires you to connect and interact with peers. One aspect of the grading is participation. My advice: answer others’ questions as much as possible! Not only are you increasing your grade, but also, as you explain these perplexing concepts to peers – you are learning the material better. Your knee-jerk reaction is to speed through the course, but go ahead and spend the extra hour. This is another great way to make lasting connections because you are investing in others’ education, not just your own.

Once you’re signed up for the program, you have the opportunity to join your classmates in one large Facebook group, as well as cohort-specific Facebook groups. As you start to browse their profile, yep, Facebook stalk, your section mates, you’ll quickly realize how unaccomplished you are. No, really. These accomplished adventurers you will meet are CEO’s of Silicon Valley startups, aids in Washington, DC, and interns at Facebook. They are world changers, to say the least. So, don’t just grow your LinkedIn profile – communicate with these people. Network. Establish relationships.

Putting it all together

The question I have been asked the most, “So what else did you get from this program?” The course taught us the language of business, and it also taught us how to take a case and apply the principles we learned. It challenged us mentally and intellectually, to think critically and analytically. And it taught us how to visualize problems and solutions through a different lens.

After 11 weeks of a rigorous work load – there were three finals to prepare for, that we took at one time at a testing center, that is timed, where there is a whole thirty second break, so you have just enough time to breath (maybe).

Reflecting back to the beginning, I never thought I’d finish. It was a dark tunnel for the longest time, and I still cannot believe I passed. I told myself the entire way, even if I failed the entire thing – I was going to make it to the very end. I could forgive myself if I failed; I could get back up from failure, but I could not forgive myself if I gave up.

These courses were an uphill battle. It was an incredibly difficult journey to get from point A to point B. But does anything actually worth having come easy? Experience CORe, or similar courses – it’s worth the challenge; challenge yourself (in ways you never thought possible) make connections, and use this knowledge to change your world and the world around you.

Thank you, Harvard Business School and Professors Bharat Anand, Jan Hammond, and V.G. Narayanan for this incredible and enlightening journey.

About the Author

Sam Campbell participated in the June 2015 cohort of HBX CORe. He is a college student and manager of an online multimedia forum called The Bitter Student.